Our Approach

Our team takes a customized approach to advising investors and unlocking the power of real estate investments.

Our team takes a customized approach to advising investors and unlocking the power of real estate investments.

Our services are designed to help you master the art of real estate investing. Whether you're interested in multifamily, retail, or industrial investment properties, our team is prepared to give you an inside look at how to make profitable deals.

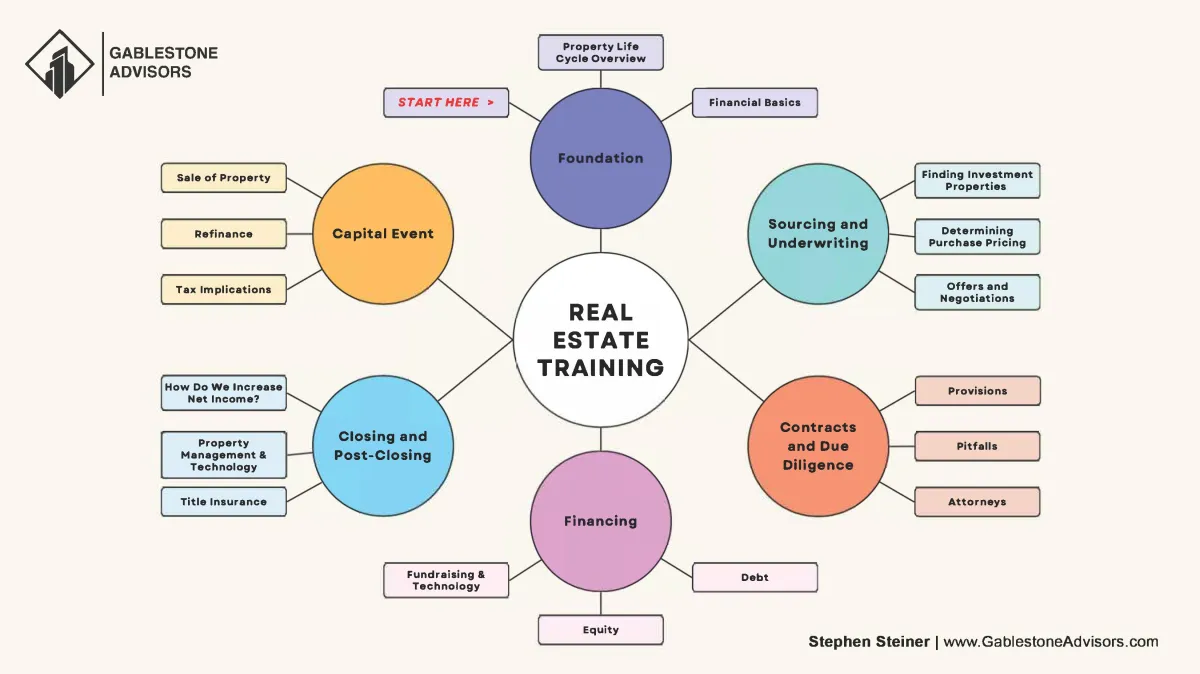

Here's an overview of our proprietary course flowchart:

Our team of experts looks forward to assisting you and your organization through every stage of the Real Estate Investment Cycle.

Understanding these phases is crucial for investors and professionals:

Acquisition – Identifying and purchasing properties.

Development/Improvement – Enhancing property value through renovations or new construction.

Stabilization – Ensuring the property generates steady income.

Hold & Manage – Managing the property for optimal returns.

Disposition – Selling or refinancing the property to maximize returns.

Finding Investment Properties – Identifying deals through market analysis, networking, and listing platforms. Determining

Purchase Pricing – Using comparative market analysis (CMA), income approach, and cost approach.

Offers and Negotiations

Structuring offers strategically based on property valuation and market conditions.

Legal and risk assessment is essential in real estate transactions:

Key Contract Provisions – Understanding contingencies, financing clauses, and risk mitigation terms.

Common Pitfalls – Avoiding contract loopholes, environmental concerns, and zoning issues.

Attorney’s Role – Ensuring compliance with legal requirements and mitigating liability.

Understanding funding mechanisms and financial structuring:

Fundraising & Technology – Crowdfunding, syndication, and investor relations platforms.

Debt Financing – Loans, mortgage structures, and lender requirements.

Equity Financing – Partnerships, joint ventures, and private equity investments.

Finalizing transactions and optimizing property operations:

Maximizing Net Income – Cost control, rent optimization, and expense reduction to increase the value of the property.

Property Management & Technology – Leveraging software for lease tracking, maintenance, and financial reporting.

Title Insurance – Protecting against ownership disputes and title defects.

Exit strategies and financial implications:

Property Sale – Selling the asset at peak market value.

Refinancing – Leveraging improved asset value for better loan terms.

Tax Implications – Capital gains tax, 1031 exchanges, and depreciation recapture.

Established by Stephen Steiner, Gablestone Advisors is a trusted leader in real estate investment, known for generating consistent returns across multifamily, retail, and industrial sectors. Through a personalized, strategic approach, we help clients unlock long-term value and capitalize on real estate opportunities.

© Copyright 2025. Gablestone Advisors. All rights reserved.